The Art of the Con

How we can avoid falling prey to con men such as Bernard Madoff

On a Los Angeles street corner in 2000, I was the “inside man” in a classic con game called the pigeon drop. A magician named Dan Harlan orchestrated it for a television series I cohosted called Exploring the Unknown (type “Shermer, con games” into Google). Our pigeon was a man from whom I asked directions to the local hospital while Dan (the “outside man”) moved in and appeared to find a wallet full of cash on the ground. After it was established that the wallet belonged to neither of us and appeared to have about $3,000 in it, Dan announced that we should split the money three ways.

I objected on moral grounds, insisting that we ask around first, which Dan agreed to do only after I put the cash in an envelope and secretly switched it for an envelope with magazine pages stuffed in it. Before he left on his moral crusade, however, Dan insisted that we each give him some collateral (“How do I know you two won’t just take off with the money while I’m gone?”). I enthusiastically offered $50 and suggested that the pigeon do the same. He hesitated, so I handed him the sealed envelope full of what he believed was the cash (but was actually magazine pages), which he then tucked safely into his pocket as he willingly handed over to Dan his entire wallet, credit cards and ID. A few minutes after Dan left, I acted agitated and took off in search of him, leaving the pigeon standing on the street corner with a phony envelope and no wallet!

After admitting my anxiety about performing the con (I didn’t believe I could pull it off) and confessing a little thrill at having scored the goods, I asked Dan to explain why such scams work. “We are that way as the human animal,” he reflected. “We have a conscience, but we also want to go for the kill.” Indeed, even after we told our pigeon that he had been set up, he still believed he had the three grand in his pocket!

Greed and the belief that the payoff is real also led high-rolling investors to fuel Wall Street financier Bernard Madoff’s record-breaking $50-billion Ponzi scheme in which he kept the money and paid an 8 to 14 percent annual annuity with cash from new investors. As long as more money comes in than goes out, such scams can continue, which this one did until the 2008 market meltdown, when more investors wanted out than wanted in. But there were other factors at work as well, as explained by the University of Colorado at Boulder psychiatry professor Stephen Greenspan in his new book The Annals of Gullibility (Praeger, 2008), which, with supreme irony, he wrote before he lost more than half his retirement investments in Madoff’s company! “The basic mechanism explaining the success of Ponzi schemes is the tendency of humans to model their actions, especially when dealing with matters they don’t fully understand, on the behavior of other humans,” Greenspan notes.

The effect is particularly powerful within an ethnic or religious community, as in 1920, when the eponymous Charles Ponzi promised a 40 percent return on his fellow immigrant Italian investors’ money through the buying and selling of postal reply coupons (the profit was supposedly in the exchange rate differences between countries). Similarly, Madoff targeted fellow wealthy Jewish investors and philanthropists, and that insider’s trust was reinforced by the reliable payout of moderate dividends (so as not to attract attention) to his selective client list, to the point that Greenspan said he would have felt foolish had he not grabbed the investment opportunity.

The evolutionary arms race between deception and deception detection has left us with a legacy of looking for signals to trust or distrust others. The system works reasonably well in simple social situations with many opportunities for interaction, such as those of our hunter-gatherer ancestors. But in the modern world of distance, anonymity and especially complicated investment tools (such as hedge funds) that not one in a thousand really understands, detecting deceptive signals is no easy feat. So as Dan reminded me, “If it sounds too good to be true, it is.”

March 19th, 2009 at 6:38 pm

I wish there were an indication of what proportion of people fall for the pigeon drop con.

March 19th, 2009 at 8:21 pm

Front runnng and greed.

Were the victims as innocent as they seem?

Some of the investors in Madoff’s fund

didn’t know they were investing with him—

let’s leave them out.

For the rest, there’s evidence that

some of them didn’t believe that Madoff

was actually investing using the system

that he described.

For example, the 1999 and 2005 whistle

blowing report google

Trying to Blow The Whistle on Madoff

said that almost certainly Madoff was

a ponzi scheme — but there was a chance

that it was a front running scheme.

So people who didn’t think it was a ponzi

scheme may have been happy to get

unrealistic returns because they thought

Madoff was front running and thereby

getting easy guaranteed profits at the

expense of retail investors.

May 10th, 2009 at 5:55 pm

I am amazed at what I perceive as the con of the Motivational Speakers. I watched a one day seminar recently and became astounded at how the speaker used emotional subjects to get the audience convinced to buy his books and CDs. Seemed like I was in church and watching people getting worked up over the next coming.

June 5th, 2009 at 4:02 am

What on earth is the big ‘wow’ here? We live in a society in which having money means ‘good’ while having no, or little, money means ‘bad’. A guy thinks some money had been found and that its rightful owner may not be traceable. The way the conversation progressed, he was included in the ‘find’, so to speak. He ‘joined in’ i.e. trusted the two conmen, because he didn’t realise that there are some people in the world, like you Shermer, who don’t have proper jobs and who can spend their time amusing themselves with this kind of nonsense. If the guy had seen the wallet falling from someone’s pocket, the chances are he’d have simply handed it back. Perhaps he wouldn’t have done so. Well, there you have it folks, Shermer’s great revelation: some people are more honest than others, and some people can be conned rather easily. As I asked above, where’s the big ‘wow’?

Sometimes, Mr Shermer, I think you are the one of the greatest of the most pointless titheads on this planet.

June 5th, 2009 at 1:34 pm

Hey NMcC,

Is this your wallet?

June 7th, 2009 at 8:49 am

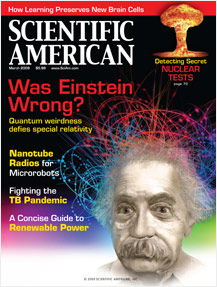

Michael Shermer is, among other things, the editor-in-chef of a magazine and a writer and contributor to Scientific American. Those are real jobs.

Maybe NMcC should try to read some of Shermer’s books.

June 9th, 2009 at 1:16 pm

j_hotch:

Your point being?

Moridin:

“Michael Shermer is, among other things, the editor-in-chef (sic) of a magazine…”

Yes, his own.

“…and a writer and contributor to Scientific American.”

Churning out the kind of pointless drivel evidenced above.

“Maybe NMcC should try to read some of Shermer’s books.”

Er, like The Mind of the Market? The one in which disciple Shermer pays homage to High Priest market? When was that published, now? Oh yes, at the time the market was collapsing and being bailed out around the world by the State.

The genius is palpable.

July 11th, 2009 at 9:11 pm

@everyone else: booyah! question everything!

July 15th, 2009 at 12:00 pm

Bernie Madoff was sentenced to 150 years in prison for running a Ponzi scheme. Congress has been running a Ponzi scheme since 1935 (Social Security), so why aren’t they in jail?

October 2nd, 2010 at 6:18 pm

http://www.frostcloud.com/forum/showthread.php?p=455862&mode=threaded#post455862

Whatever history has taught US strange lessons by folly of game shells.

That which is foolish to do leads to desolate outcomes by time wasted.

Consider this: losing your religion to republican aristocracies: hells bells.

Bow down to mammon’s mummy idol in give or take of time we plastered.

Fleece immigrants before they step up sum social some ladder in fashions.

A line of reasoning as a series of points off for a walk in the fascists snow.

Job that is present day economic self worth by trade workers in passions.

For goods by stakeholders called capitalist by socialist on paternoster row.

Ownership of property rights for the state system of tax extraction floats.

Over tacks taxonomic watch out the taxidermist will stuff evils predators.

Predation of ones time for another’s law of reciprocity so who made boats?

Follow tribal heard leaders if not kill all louts in their pens with ink blotters.

Charles Ponzi the conman who sat like a cat on a mat that social pyramid.

Never noticing one US dollar bill has an all seeing eye at top of its pyramid.

peat